Holiday shopping will look different for retailers this year, software provider Salesforce said as it announced five predictions for the the end of 2024.

The company, which provides cloud-based services and an ecommerce platform for merchants, expects “a challenging season” for shoppers and retailers alike. And “we can’t say shoppers didn’t warn us,” Salesforce said. That’s because shoppers have been searching for savings and waiting to make big purchases, it said.

“After remaining largely resilient throughout four years of economic uncertainty, consumers are finally feeling the pinch,” Salesforce said in a statement. “From sustained inflation to supply chain woes, consumers worldwide have been through a lot.”

Nearly a third of global shoppers (32%) reported using alternative credit services like buy now, pay later (BNPL) more frequently this year, according to Salesforce research.

Salesforce defines the holiday season as Nov. 1 through Dec. 31. In North America, 76 of the Top 2000 online retailers use Salesforce as their ecommerce platform, according to Digital Commerce 360 data. In 2022, those 76 online retailers combined for more than $116.97 billion in web sales.

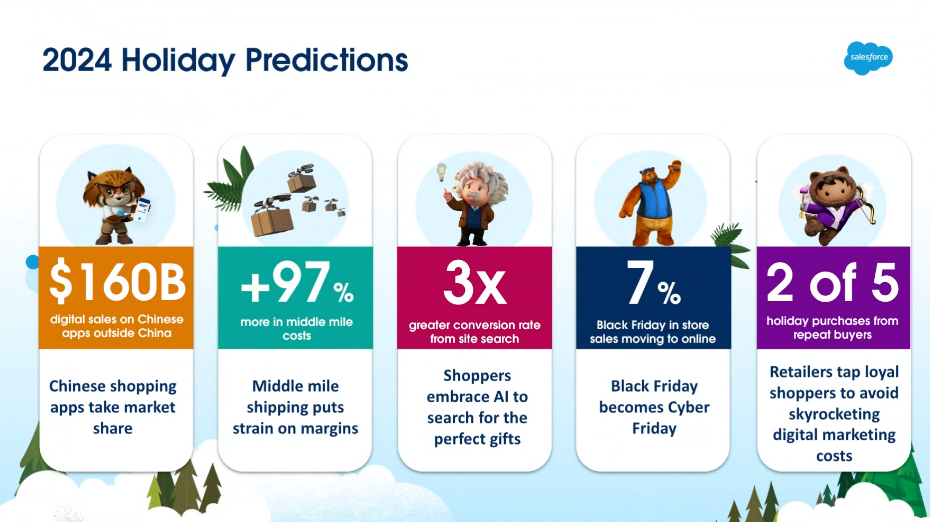

Here are Salesforce’s five predictions about the 2024 holiday shopping season.

1. Chinese shopping apps will take over

The first Salesforce holiday shopping prediction revolves around two factors: prices and China. The company said 63% of Western consumers plan to purchase from Chinese shopping apps during the 2024 holiday season. That includes merchants such as Aliexpress, Cider, Shein, Temu and TikTok. And it all comes down to price, Salesforce said.

Rob Garf, vice president and general manager of retail at Salesforce, said sales increases have been “almost purely because of price increases, not increase in products sold.”

Order volumes have been falling since 2022, Salesforce said, and shoppers want their purchases to feel worth it. Salesforce projects that these Chinese shopping apps will take 21% of sales outside China itself in the 2024 holiday season.

2. Middle-mile shipping puts strain on margins

The second Salesforce prediction is that brands and retailers will spend an extra $197 billion on middle- and last-mile expenses during the 2024 holiday shopping season. That would be a 97% increase over last year’s holiday season.

The company said attacks in the Red Sea from Yemen-based Houthi forces and rising crude oil prices are driving container costs up worldwide. A Houthi spokesperson stated in December that they would target “ships affiliated to Israel or transporting commodities to Israeli ports” and continue to do so if “food and medicine keep not accessing the Gaza Strip.”

Salesforce cited a Reuters report assessing that “any ceasefire agreement would lessen the tension in the Middle East.” To date, Israel and Hamas have not agreed on terms for a ceasefire that would end the current Israeli military campaign. Israel has pushed for a six-week ceasefire, whereas Hamas has pushed for a permanent ceasefire.

Moreover, the collapse of the Francis Scott Key Bridge in Baltimore has stalled delivery times and added expenses for retailers. But despite these challenges, Salesforce said, retailers shouldn’t push shipping expenses onto consumers.

More than half of shoppers say they are more likely to purchase online than in a store if delivery is free, according to Salesforce. This is also in line with Digital Commerce 360 research.

Garf said retailers are getting more stringent about returns, as well. That has also led to retailers pushing buy online, pick up in store (BOPIS).

3. Shoppers embrace AI to search for the perfect gift

Salesforce said that artificial intelligence (AI) influenced 17% of online purchases during the 2023 holiday shopping season. Predictive and generative AI contributed to $199 million in online sales during the 2023 holiday shopping season, it said.

This year, Salesforce anticipates that more consumers will leverage AI, whether they know it or not. Already, 53% of shoppers Salesforce surveyed said they are interested in using generative AI for discovering gift ideas.

As Google embeds generative AI into its search tool, Salesforce said, retailers will be able to transition from keyword searches to natural prompts for finding products on their websites. Salesforce said it predicts search will drive a conversion rate nearly 3x better compared to traffic not engaged with site search. It also predicts a 1.8% conversion rate across all geographies and verticals in the 2024 holiday shopping season.

Salesforce announced AI, Data Cloud and Commerce Cloud features at its Connections 2024 conference at McCormick Place in Chicago on May 22 and 23.

4. Black Friday becomes Cyber Friday

Among the Salesforce predictions is that ecommerce will capture 7% of in-store sales on Black Friday.

Nearly two-thirds of shoppers Salesforce surveyed said they’re waiting until the Cyber 5 period to make large holiday purchases.

“The big news is that Black Friday is going to be the biggest day for digital,” Salesforce said.

Survey respondents cited convenience, free delivery and the ability to search for the best prices as their top reasons for going online. Additionally, 72% of surveyed consumers told Salesforce they prefer to shop online during Black Friday.

5. Retailers tap loyal shoppers to avoid skyrocketing digital marketing costs

Digital marketing costs are becoming more expensive as the United States prepares for another presidential election and Chinese companies buy more advertising inventory, Salesforce said.

“This means that brands and retailers have to better engage their existing customer base amid this tug of war over digital advertising space,” it said.

As a result, Salesforce said, shoppers are doubling down on loyalty programs. 63% of shoppers are making more purchases from stores where they can earn and redeem loyalty points, Salesforce said.

Salesforce Shopping Index data indicates that the rate of repeat buyers increased 8% over the last two years. Furthermore, 46% of shoppers say earning and redeeming loyalty points is the second-highest factor, behind price, influencing where they buy, according to Salesforce data.

The final Salesforce holiday prediction is that loyal, repeat buyers will make 40% of purchases in the 2024 holiday season.

“This season will be competitive, intense, and no doubt all about pricing and discounting strategies,” Salesforce said. “It’s never been more important to rely on your customer data for guidance and insight into marketing campaigns — especially the holiday promotional calendar — that keep your loyal customers buying more and buying from you.”

Do you rank in our databases?

Submit your data and we’ll see where you fit in our next ranking update.

Sign up

Stay on top of the latest developments in the ecommerce industry. Sign up for a complimentary subscription to Digital Commerce 360 Retail News. Follow us on LinkedIn, Twitter, Facebook and YouTube. Be the first to know when Digital Commerce 360 publishes news content.

Favorite