U.S. Customs and Border Protection (CBP) announced new action as part of an effort to curb exploitation of de minimis rules for small-value ecommerce orders. At issue for these imports are activities within the scope of the agency’s Entry Type 86 Test and the treatment of Section 321 of the U.S. Tariff Act of 1930.

How CBP proceeds could have implications for international retailers, including China-originated shipments ordered through Shein and Temu. The companies fell under scrutiny by the U.S. House Select Committee on the Chinese Communist Party in 2023, along with other companies.

During the investigation, the committee looked at the current de minimis environment for imports. An update in 2016 allowed that a single person on one day could import articles with a total value of up to $800 without formal customs declarations. That de minimis threshold allows shipments to avoid certain import duty and tax obligations. It was raised from a previous level of $200.

“Temu and Shein alone are likely responsible for more than 30 percent of all packages shipped to the United States daily under the de minimis provision, and likely nearly half of all de minimis shipments to the U.S. from China,” the bipartisan committee’s report claimed.

Shein is No. 2 in Digital Commerce 360’s Asia Database ranking ecommerce retailers in the region by online sales. The online apparel retailer was valued at $66 billion in May 2023 when it closed its latest funding round.

PDD Holdings owns Temu, which launched in 2022 and isn’t yet reflected in the database. PDD also owns Pinduoduo, which operates an app-only marketplace for Chinese consumers. Because it doesn’t operate an ecommerce website, Pinduoduo is not included in Digital Commerce 360’s Asia Database.

How will US Customs enforce de minimis rules for ecommerce?

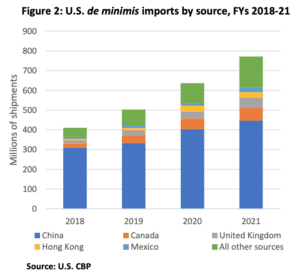

U.S. de minimis imports | Image source: U.S. International Trade Commission

“While balancing our economic security and trade facilitation mission with our law enforcement responsibilities, CBP is taking action to ensure compliance and minimize the exploitation of the small package, or de minimis, environment,” said Troy Miller, acting commissioner at CBP, in a statement released May 31. “While the majority of brokers, carriers, and supply chain businesses that participate in CBP’s Entry Type 86 Test are compliant with applicable laws, we are enhancing our enforcement efforts to ensure that all participants are held accountable when they are not.”

The U.S. International Trade Commission published a briefing in November 2023. Its author concluded that most imports using the de minimis standards came from China.

“The majority of these imports, shipped by postal and express delivery services, are retail products purchased online,” the report stated. “Section 321 imports have been the key channel for Chinese business-to-consumer (B2C) online retailers that ship direct from factories or distribution centers in China to U.S. consumers.”

It also cited those imports as a source of interest in Congress.

“The large volume and fast growth of these imports from China since 2018 has led to increased Congressional scrutiny and proposed legislation to modify what some have called an outdated program not suited to the current trade environment of surging cross-border e-commerce,” the report found.

Implications for Shein and Temu

In addition, the International Trade Commission briefing stated that Chinese ecommerce firms had “exploited” the increased U.S. de minimis level and minimized inspections. It also characterized the outcome for “Chinese e-commerce providers” being increased U.S. market share.

“In particular, Shein and Temu, online Chinese fast fashion retailers, reportedly accounted for over 30 percent of U.S. de minimis imports in 2022,” the briefing stated. “Shein has maximized the direct-to-consumer business model and it eclipsed leading U.S. firms in the category in 2022, with U.S. revenues growing from under $500 million in 2018 to over $3 billion in 2022. Temu’s business model also relies heavily on U.S. de minimis treatment.”

Already, CBP has taken action against an unknown number of brokers that it found to be posing compliance risks.

“To date, CBP has suspended multiple customs brokers from participating in the Entry Type 86 Test after determining that their entries posed an unacceptable compliance risk,” Miller said.

Those brokers will be eligible for reinstatement. However, they must demonstrate to CBP that they have “developed and implemented a remedial action plan,” he explained.

Shein’s potential IPO in London

Shein reportedly filed confidentially for a public offering in the U.S. last November. However, those plans face obstacles, including regulatory scrutiny in the U.S. and in China, where it was founded. Instead, the company has since shifted talk to the U.K. for a possible London-based public offering. That filing could come any day, Sky News reported on June 3.

Do you rank in our database?

Submit your data with this quick survey and we’ll see where you fit in our next ranking update.

Sign up

Stay on top of the latest developments in the ecommerce industry. Sign up for a complimentary subscription to Digital Commerce 360 Retail News. Follow us on LinkedIn, Twitter, Facebook and YouTube. Be the first to know when Digital Commerce 360 publishes news content.

Favorite