Online grocery sales grew year over year in the U.S. in April, according to data from the monthly Brick Meets Click and Mercatus Grocery Shopping Survey.

Delivery sales continue to benefit from interest and investment in third-party providers and Walmart, said David Bishop, partner at Brick Meets Click.

“One question related to this growth remains whether many of the newer customers who are attracted by the trial offers will behave like streaming subscription service users who choose to use one service at a time until the ‘free’ period expires, and then jump to the next special offer,” Bishop said.

Grocery executives need to focus on technology that enhances the shopping experience, whether that’s online or in-store, said Mark Fairhurst, chief growth officer at Mercatus, in a statement. Mass merchants, such as Walmart and Target, “have already invested heavily in their mobile apps,” he said. Now, they’re “tapping into emerging technologies like machine learning and AI to better predict and adapt to customer behavior in real-time.”

More online grocery shoppers are buying from mass merchants as they seek cost savings and benefit from membership and subscription programs, Brick Meets Click and Mercatus said.

Brick Meets Click and Mercatus define the three receiving methods for online grocery sales as:

- Delivery: Includes orders received from a first- or third-party provider like Instacart, Shipt or the retailer’s own employees.

- Pickup: Includes orders received by customers either inside or outside a store or at a designated location/locker.

- Ship-to-home: Includes orders that are received via common or contract carriers like FedEx, UPS, USPS, etc.

April online grocery sales in the US

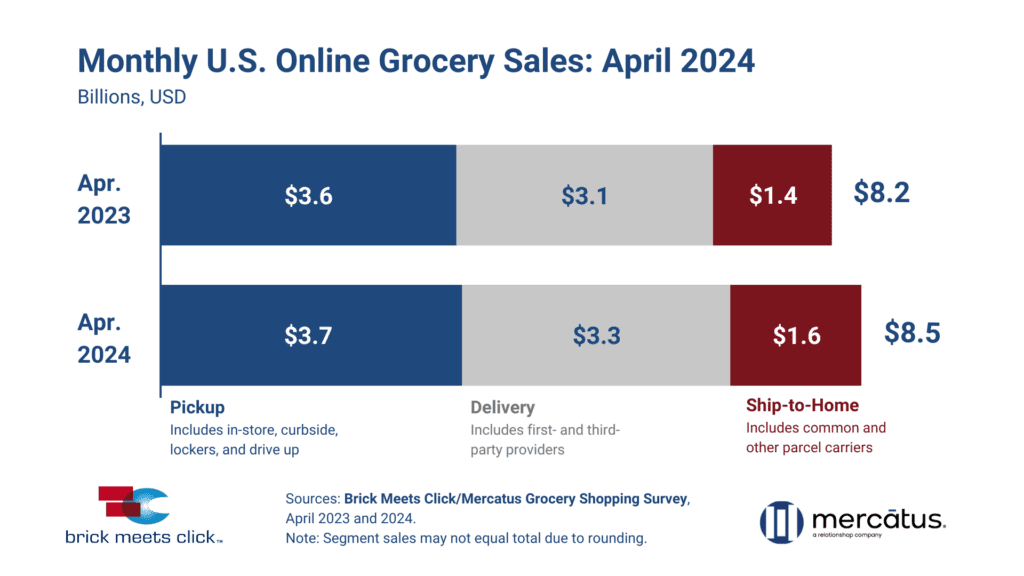

Online grocery sales in April grew to $8.5 billion in 2024. That’s up 4.4% from $8.2 billion in 2023, according to Brick Meets Click and Mercatus.

Pickup sales accounted for the most sales, whereas ship-to-home had the largest year-over-year gain of the receiving methods. In April 2024, U.S. online grocery shoppers spent $3.7 billion on pickup. That’s 2.1% growth over April 2023’s $3.6 billion in pickup sales. Brick Meets Click attributed the growth to increased average order value (AOV). At the same time, order volume and monthly active users both dropped.

Delivery accounted for $3.3 billion in April 2024 online grocery sales. That’s 4.3% growth over $3.1 billion in April 2023. Monthly active users increased among all surveyed age groups, Brick Meets Click and Mercatus said. That helped increase order volume year over year, “while AOV remained essentially unchanged,” they said.

Ship-to-home accounted for the smallest portion of the three fulfillment methods but grew the most year over year at 10.2%. Sales grew to $1.6 billion this year from $1.4 billion in 2023. Brick Meets Click and Mercatus attribute the increase “to a substantial year-over-year increase in AOV, after rebounding from a dramatic drop in AOV in 2023 versus 2022.”

Impact of mass merchants

Mass merchants supplied orders to 51% of monthly active users who shop online for groceries, they said. The share of shoppers who order online from supermarkets and discount grocery stores who also ordered groceries from mass merchants increased to nearly 34%, they added.

For households that primarily buy groceries from a mass merchant and also buy groceries online, 83% completed one or more online grocery orders with their primary grocer in April 2024. In comparison, for households that primarily shop at supermarkets and buy groceries online, 54% bought groceries online from a supermarket.

Do you rank in our databases?

Submit your data and we’ll see where you fit in our next ranking update.

Sign up

Stay on top of the latest developments in the ecommerce industry. Sign up for a complimentary subscription to Digital Commerce 360 Retail News. Follow us on LinkedIn, Twitter, Facebook and YouTube. Be the first to know when Digital Commerce 360 publishes news content.

Favorite